Whether you’re buying your first car or upgrading to a newer model, understanding how your credit score affects your ability to finance a vehicle in California is essential. Your credit score doesn’t just determine whether you get approved—it also impacts your interest rate, down payment, and loan terms.

Let’s walk through everything you need to know about credit scores and car buying in California—what’s considered a good score, what you can qualify for at different levels, and how to improve your financial standing before applying for a loan.

WHY CREDIT SCORE MATTERS WHEN BUYING A CAR

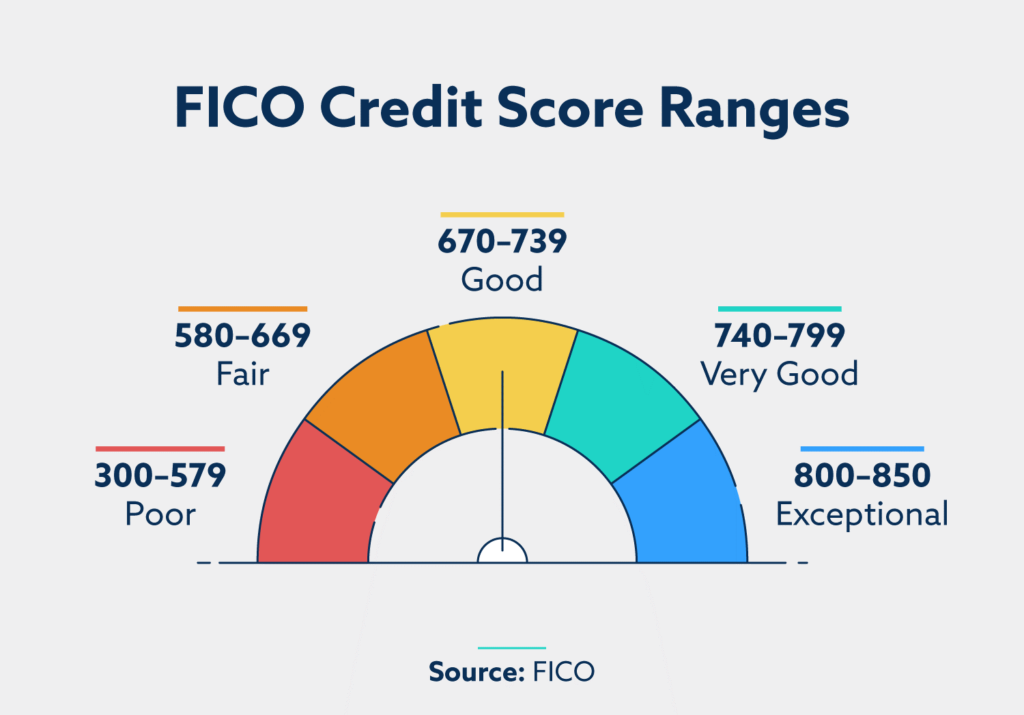

Your credit score is a three-digit number that tells lenders how reliable you are at repaying borrowed money. In the eyes of banks, credit unions, and finance companies, your score reflects your financial behavior.

Lenders group credit scores into different tiers, and these tiers affect the interest rate you’ll receive. Higher credit scores signal that you’re a low-risk borrower. As a result, lenders will likely offer you:

- Lower interest rates

- More flexible loan terms

- Lower down payment requirements

- Approval for higher vehicle price ranges

On the other hand, if your score is lower, you may still get approved—but expect less favorable terms and higher monthly payments.

MINIMUM CREDIT SCORE TO BUY A CAR

There’s no official minimum credit score to buy a car in California. However, here’s what most buyers can expect based on their credit:

✅ Good Credit (661 and above)

If your score is 661 or higher, you’re in a favorable position and will likely qualify for the lowest available interest rates. Many buyers in this range secure financing without needing a large down payment and have access to new cars, certified pre-owned vehicles, and promotional offers.

- Loan Approval: Very likely

- Interest Rates: Competitive

- Down Payment: Optional or low

- Best For: Prime or Certified Pre-Owned (CPO) vehicles

⚠️ Fair Credit (600–660)

Between 600 and 660, you can still qualify for financing, but lenders may see you as a moderate risk. Expect higher rates and possibly a requirement for a larger down payment. You may have fewer options when it comes to loan terms or vehicle selection.

- Loan Approval: Possible, with higher APR

- Interest Rates: Moderate to high

- Down Payment: Often required

- Best For: Reliable used cars or entry-level new vehicles

❗ Bad Credit (below 600)

Even with a credit score under 600, you can still qualify for financing—particularly in California, where many lenders and dealerships offer programs tailored for credit-challenged buyers. However, interest rates will be significantly higher, and you’ll often need to make a substantial down payment to secure a loan.

- Loan Approval: Possible through subprime lenders

- Interest Rates: Very high

- Down Payment: Typically required (10%–20%)

- Best For: Budget used cars, “Buy Here Pay Here” lots, or special financing programs

MORE: How to Buy a Car with Bad Credit

THE IMPACT OF YOUR CREDIT SCORE ON MONTHLY CAR PAYMENTS

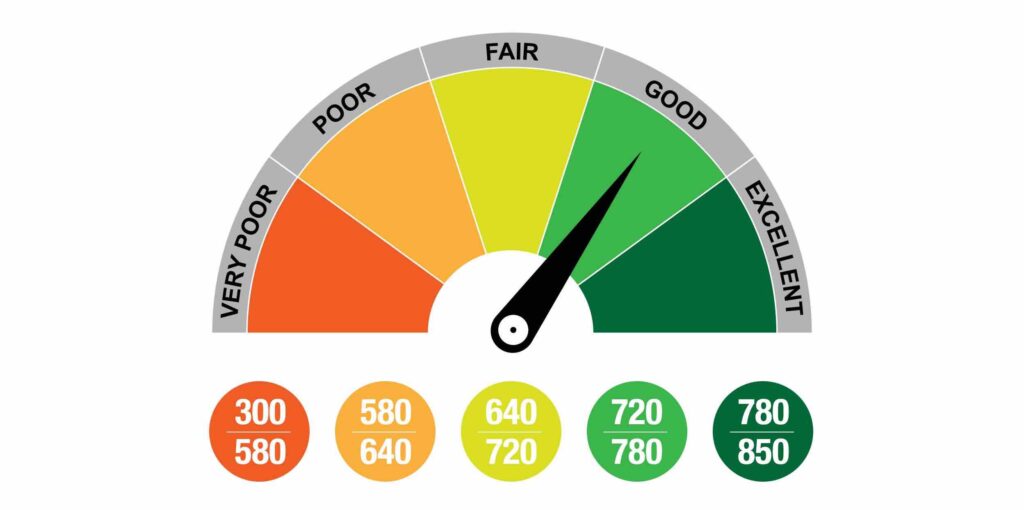

Your credit score doesn’t just determine whether you’ll get approved for a car loan—it plays a major role in how much you’ll pay every single month. Even a difference of 50–100 points in your score can lead to thousands of dollars in savings or added cost over the life of the loan.

Let’s break it down using a $25,000 loan financed over 60 months (5 years):

✅ 661 and Above (Good to Excellent Credit)

With a top-tier credit score, you’re likely to qualify for the lowest available interest rates, often between 4% and 6% (depending on the lender and vehicle).

- Estimated APR: 5.0%

- Monthly Payment: Around $472

- Total Interest Paid: Approximately $3,320 over 5 years

This gives you the power and flexibility to negotiate better terms, choose from more lenders, and potentially put less money down while still enjoying affordable payments.

⚖️ 600–660 (Fair to Moderate Credit)

With a mid-range credit score, you’re not considered high-risk, but you may still face moderate interest rates—typically between 8% and 12%, depending on the lender.

- Estimated APR: 9.5%

- Monthly Payment: Around $525

- Total Interest Paid: Approximately $6,500

Here, you’re still in a position to qualify for traditional auto loans, but the cost of borrowing is noticeably higher. Over five years, you could pay about double the interest compared to someone with a score of 661 or higher.

❗ Below 600 (Poor Credit)

When your credit dips below 600, lenders typically consider you a higher-risk borrower, which means steep APRs ranging from 15% to 20% or more.

- Estimated APR: 16.0%

- Monthly Payment: $608

- Total Interest Paid: $11,480

That’s more than $8,000 in extra interest compared to someone with a strong credit score. In many cases, lenders may also require a larger down payment, proof of steady income, or a co-signer.

MORE: What to Know Before Committing to a Used Car

PURCHASING A CAR WITH NO CREDIT HISTORY

If you have no credit history—meaning you’ve never used a credit card or taken out a loan—you’re considered an “unscorable” borrower. Lenders won’t have any data to predict your repayment behavior. Still, this doesn’t automatically disqualify you from getting a loan.

In California, many dealerships and credit unions offer first-time buyer programs tailored to individuals with no credit. These programs often require:

- Proof of steady income

- Verification of employment

- A larger down payment

- Possibly a co-signer with stronger credit

MORE: Explore Additional Tips on Purchasing with No Credit History

TIPS TO IMPROVE YOUR CREDIT SCORE

Improving your credit score—even by 20 to 40 points—can open the door to better rates and bigger savings. Here are five steps you can take:

1. Check Your Credit Report for Errors

Visit AnnualCreditReport.com and review your report from all three major bureaus. Dispute any inaccurate information, especially missed payments or incorrect account balances.

2. Pay Down Revolving Debt

Credit utilization accounts for about 30% of your credit score. Aim to keep your usage under 30%, and under 10% if you want optimal results. Paying down credit cards can boost your score quickly.

3. Make Payments on Time

On-time payment history is the most important factor in your score. It makes up about 35% of your credit score. Set up autopay for credit cards and loans to avoid late payments.

4. Avoid New Credit Applications

Every new credit inquiry can temporarily drop your score. Avoid opening new accounts in the months leading up to your car purchase.

5. Build Credit Strategically

Consider a secured credit card or a credit-builder loan from a credit union to demonstrate responsible borrowing habits.

WHERE TO GET AN AUTO LOAN

Dealership Financing

Most car dealerships work with a network of lenders—including banks, credit unions, and specialized auto finance companies. This makes it easy to compare multiple offers in one place. Some dealerships also have special finance departments that focus on helping buyers with bad credit or no credit history.

Credit Unions

Local institutions like Golden 1 Credit Union, SchoolsFirst FCU, or Navy Federal tend to offer lower interest rates than big banks. They often have more flexible lending criteria and may be more willing to work with moderate credit scores.

Online Lenders

Platforms like Capital One Auto Navigator, Carvana, and AutoPay let you pre-qualify for financing online—without affecting your credit. This gives you a clear idea of your budget before you even step into a dealership.

Buy Here Pay Here Dealerships

These lots finance customers directly, without involving outside banks. They typically approve almost anyone, regardless of credit score. However, interest rates are often very high, and some may not report payments to credit bureaus—limiting your ability to rebuild credit.

Always read the fine print and ask questions before committing to any financing offer.

FINAL THOUGHTS:

While your credit score can impact your loan options, the good news is that you don’t need a perfect credit to drive off in the car you need. California offers flexible programs for buyers across all credit tiers, and with a little preparation, you can position yourself to get better rates and more choices.

If your score is already strong, use that to your advantage by comparing multiple lenders and negotiating terms. If you’re rebuilding or starting from scratch, focus on progress and work with dealerships or credit unions that understand your situation.

Every on-time payment after you purchase will help strengthen your credit for the future.