When you finance a used car, your interest rate (APR) doesn’t just “slightly” change your payment—it can be the difference between a comfortable budget and years of overpaying. A 2–4% APR swing (very common between excellent credit and average credit) can add thousands in total interest, even if the monthly payment only looks a little higher.

This guide explains how APR affects your monthly payment, total interest, and how fast you build equity—plus the smartest ways to lower your rate.

⚠️ WHY INTEREST RATE MATTERS

An interest rate isn’t just a percentage—it’s the cost of borrowing money. APR (Annual Percentage Rate) represents the yearly cost of that borrowing. It’s more than just a “rate”; it’s how lenders price the risk of your loan. Every dollar you finance accrues interest over time, and that cost compounds across months or even years.

5 Key Truths Most Buyers Miss:

- APR affects what you actually pay, not just what you see on paper.

- APR is not the car price. You can negotiate a great price and still lose money with a high APR.

- Even a small APR difference can add up to thousands of dollars over the life of a car loan.

- Longer loan terms often lower the monthly payment but hide higher total interest costs.

- APR is not one-size-fits-all. Used car interest rates vary based on credit score, lender, loan term, and vehicle factors.

According to Experian reports, average used car loan rates have recently hovered in the low double digits. However, your actual APR can be significantly higher—or lower—depending on your credit profile and loan terms.

👉 Understanding APR is critical before signing any loan and helps explain why two buyers can purchase the same car and end up paying very different totals.

HOW CAR LOAN PAYMENTS ARE CALCULATED

Most car loans—especially used car loans—are amortized loans, meaning each monthly payment is split between:

- Interest – the lender’s charge for borrowing the money

- Principal – the portion that actually reduces your loan balance

Early in the loan, your balance is at its highest. Because interest is calculated on the remaining balance, more of each early payment goes toward interest and less toward principal. As the balance shrinks over time, more of each payment is applied to principal instead. This is why early payments can feel like they don’t make much progress—and why high APRs and long loan terms can lead to negative equity if you trade in early.

📜 Your monthly car payment is calculated using a standard amortized formula—the same logic used by reputable loan calculators. You don’t need to do the math yourself, but your payment is primarily influenced by 3 key factors:

- Amount financed (vehicle price minus down payment or trade-in, plus taxes and fees if rolled in)

- APR

- Loan term (number of months)

Key takeaway: APR changes the cost of every dollar you borrow, every month. Understanding how car loan payments are calculated helps you look beyond the monthly payment and evaluate the true cost of financing before you sign.

👉 Pre-qualify with Capital One to check your auto loan rates.

THE MONTHLY PAYMENT ILLUSION

Many buyers focus only on the monthly payment. Lenders know this. Extending the loan term is the easiest way to make a payment appear affordable—but you often pay much more overall.

Example: finance $25,000 at 11.5% APR:

- 48 months: ~$652/month, about $6,300 total interest

- 60 months: ~$550/month, about $8,000 total interest

- 72 months: ~$482/month, about $9,700 total interest

- 84 months: ~$435/month, about $11,500 total interest

👉 The 84-month loan saves ~$217/month—but costs $5,200+ more than a 48-month loan.

Rule of thumb for commuters / high-mileage drivers: Longer terms can make sense only if the vehicle is extremely reliable, you plan to keep it long-term, and you’re not stretching just to “make it work.”

📍 MORE: Reliable vehicles to consider if you value longer loan terms.

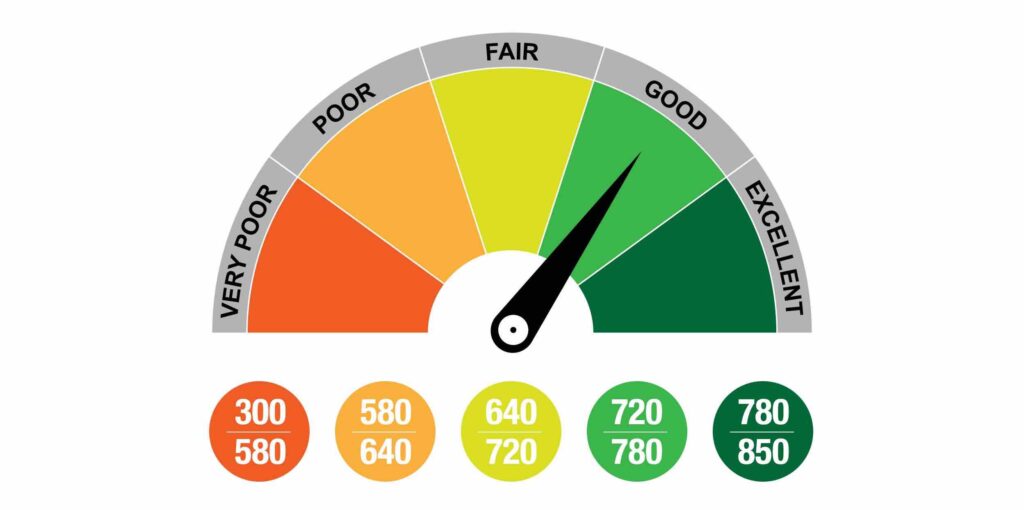

WHAT ACTUALLY DETERMINES YOUR USED CAR APR

Interest rates are risk-based. Lenders price loans based on how likely they think they’ll be repaid.

Primary Factors Lenders Use:

- Credit score & history (the #1 driver)

- Loan term (longer = riskier)

- Down payment / loan-to-value (more down can reduce lender risk)

- Vehicle age & mileage

- Lender type (credit union, bank, dealer lender, subprime lender)

Averages Used Car APR Ranges (Approximate):

Score ranges and APRs shown are approximate and may vary by lender. Rates reflect national averages, not individual loan offers.

- Super Prime credit (781+): 5-7%

- Prime credit (661-780): 7-10%

- Near Prime credit (601-660): 10-14%

- Subprime credit (501-600): 15-20%

- Deep Subprime credit (300-500): Often 20%+

According to Experian’s consumer credit reporting data and market summaries, used car APRs are often higher than new-car APRs and vary strongly by credit tier. Knowing where you fall on this spectrum helps you decide whether to improve your credit, shorten your loan term, or shop lenders before buying.

📍 MORE: No Credit History? Here’s How to Get Started.

SIMPLE VS. PRECOMPUTED INTEREST

Not all auto loans behave the same when you pay extra. Depending on how the loan is structured, additional payments may not reduce interest as much as borrowers expect—making this distinction important when paying extra or refinancing.

Simple Interest Loans (Most Common):

Most bank, credit union, and dealer-arranged auto loans today use simple interest.

- Interest accrues on outstanding balance over time.

- Paying extra principal early reduces total interest.

Precomputed Interest Loans:

Interest is calculated upfront based on the full loan term and allocated into the payment schedule. In some precomputed loans, early payoff or extra payments do not reduce interest proportionally. As a result, borrowers may see less benefit from early payoff than expected.

Precomputed interest loans are less common today and are typically associated with subprime or specialized lenders, though availability varies by state and lender. For most buyers using banks or credit unions, this won’t apply—but it’s critical to understand if you’re offered alternative financing.

What To Do:

- Review the loan agreement or Truth in Lending disclosure to confirm how interest is calculated and whether prepayment penalties apply.

- If you plan to pay extra each month, simple interest loans generally provide the most predictable interest savings.

✅ 5 MOST EFFECTIVE WAYS TO LOWER YOUR MONTHLY PAYMENT

1. Lower Your APR

A 1–3% APR improvement can save thousands over the life of a used car loan. Get preapproved from a bank or credit union, then compare with dealer financing.

2. Increase Your Down Payment 💵

Borrowing less means paying less interest overall and reduces the risk of negative equity.

3. Shorten the Term If You Can 📆

If you can comfortably afford it, shorter terms reduce total interest and help you build equity faster.

4. Buy the “Right” Price Point Vehicle

If a payment only works at 84 months, it often signals the vehicle price is stretching your budget.

5. Pay Extra Principal Early

Because early payments are interest-heavy, even modest extra principal early can meaningfully reduce total interest—especially on simple interest loans.

Example:

- $20,000 loan at 10% for 60 months

- Adding $75/month extra early can often save $1,200–$2,000 in interest and shorten the loan by several months.

Small actions early beat large actions later.

👉 Start with a pre-approval so you know your real rate before you shop.

FINAL THOUGHTS:

Interest rate is one of the most powerful—and misunderstood—factors in used car financing. When you understand how APR, loan term, and interest structure work together, you stop shopping by payment alone and start evaluating the full financial picture.

Before you sign, find a trusted dealership, compare loan terms, test different scenarios, and look beyond what “fits the budget” today. The best used-car deal isn’t the lowest monthly payment—it’s the one that protects your money long after you drive off the lot.